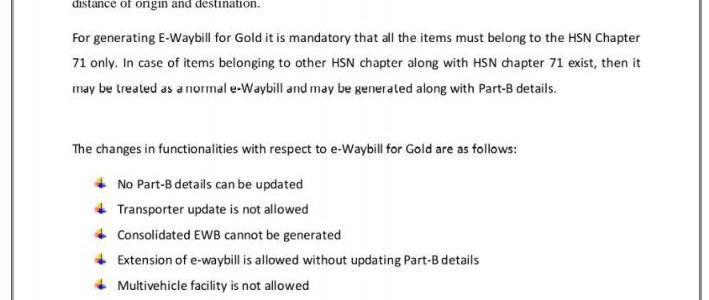

As per the notification issued by their respective states, taxpayers may generate e-Waybill for Gold (comprising items belonging to HSN Chapter 71 only) for intrastate & interstate transactions.

#ewaybill #gst

As per the notification issued by their respective states, taxpayers may generate e-Waybill for Gold (comprising items belonging to HSN Chapter 71 only) for intrastate & interstate transactions.

#ewaybill #gst

Keeping in view the problems faced by majority employers in depositing ESI Contributions, Department has relaxed the deadline for deposition of ESI Dues for the wage month of AUG-2022.

As we all are aware that the Board’s Report is prepared under subsection 3 of section 134 of the Companies Act, 2013 read with Rule 8 of the Companies (Accounts) Rules, 2014

⦁ Now, the Ministry of Corporate Affairs has amended Rule 8, after the amendment along with the existing matter contained in the Board’s Report two new matters shall be added to the Board’s Report.

⦁ The two new disclosures (along with the existing disclosures) shall be applicable for the Financial year 2021-22 and the two new disclosures are:-

Details of applications under the IBC, 2016 during the year along with their status as at the end of the financial year.

The details of the difference between the amount of the *valuation done at the time of one-time settlement and the valuation done while taking a loan from the Banks or Financial institutions along with the reasons thereof. So, you can add the above clauses in Board’s Report as follows:-

1. DETAILS OF APPLICATION MADE OR PROCEEDING PENDING UNDER INSOLVENCY AND BANKRUPTCY CODE 2016

During the year under review, there were no applications made or proceeding pending in the name of the company under the Insolvency and Bankruptcy Code, 2016

2. DETAILS OF DIFFERENCE BETWEEN VALUATION AMOUNT ON ONE-TIME SETTLEMENT AND VALUATION WHILE AVAILING LOAN FROM BANKS AND FINANCIAL INSTITUTIONS

During the year under review, there has been no time settlement of loans taken from Banks and Financial institutions

Kindly note that the above two matters shall be made in the Board’s Report only in case there is no application or proceeding pending under IBC; or where there is no loan taken or no settlement happened from the Bank.

#boardsreport #boardreport #companiesact2013 #audit #companiesaudit #statutoryaudit

Standards on Auditing are mandatory to be followed in planning and performing the audit.

For clarity on any specific matter, members can refer to the Guidance note issued by the ICAI.

Risk assessment is a critical element which should never be ignored.

One should never compromise on the audit procedures due to paucity of time.

Review mechanism within the practicing firm improves the quality of audit.

️ Never to forget Integrity, Objectivity, and Independence.

#audit #tax #auditing #icai #ca #standards

One of the certificates which are generally asked for by Banks and financial institutions is End Use Certificate. It is part of the banks’ monitoring process after the loan amount’s disbursal.

Utmost care is required from the professional in issuing these certificates. A CA should satisfy himself with documentary proof before the issue of such certificates. There should not be any chance of tolerable error.

It’s beneficial in accepting the assignment if CA knows the level of integrity of the client. The basis of certification and management explanations should be included in the relevant work papers.

#CACertificate #Audit #CompanyAudit #StatutoryAudit #TaxAudit #StockAudit #InternalAudit

Penalty cannot be imposed for incorrect address mentioned in the e-way bill, unless an inquiry is made to ascertain whether there was any intent to evade tax in mentioning the wrong address: Madras High Court

Petitioner’s transporter, on being intercepted, was found to carry GST paid goods to the petitioner’s office at Jabalpur whereas e-way bill generated showed destination as Indore. The State Tax Officer invoking its power under sec. 68 r/w sec. 129 of CGST Act, levied tax as well as penalty. Petitioner challenged the order by way of appeal but the same was rejected. Being aggrieved, petitioner moved the High Court by way of Writ Petition.

Petitioner argued that due to inadvertence during generation of the e-way bill, a clerical error took place due to which the registered address of the petitioner at Indore was mentioned in the e-way bill instead of the address at Jabalpur.

Revenue argued that exemption from the rigour of sec. 129 can only be availed on arising of contingencies as enumerated in Clause 5 of Circular No. 64/38/2018-GST, dated 14-09-2018. One of the contingencies which may extend immunity from sec. 129 relates to error in address of the consignee to the extent of locality, provided that the other details of consignee are mentioned correctly. As such, the benefit of clause 5 of the said Circular is not available to the petitioner.

The HC observed that strictly going by the terminology used in the immunity provision under Clause 5 of the circular, the benefit flowing therefrom may not be available to the petitioner, but in penal provision such as sec. 129, the element of intention to evade tax must be present to sustain an order of penalty. To gather the intention of the petitioner an inquiry must be undertaken to ascertain whether the mistake was inadvertent with no element of malice or intention to evade tax. It does not appear that either the Taxing Authority or the appellate authority has undertaken the said exercise of to ascertain the real intent behind the act of petitioner to mention wrong address.

The HC, therefore, quashed the appellate order and directed the appellate authority to reconsider the appeal solely on the question of presence or absence of any malafide intention to evade tax on the part of the petitioner and pass appropriate orders within three months.

𝗜𝗺𝗽𝗼𝗿𝘁𝗮𝗻𝘁 𝘁𝗮𝗸𝗲𝗮𝘄𝗮𝘆𝘀:

1. Element of intention to evade tax must be present in order to sustain order of penalty.

2. An inquiry must be undertaken to ascertain intention of the taxpayer as to whether the mistake was inadvertent or with intent to evade tax.

3. Penalty is not automatic and should not ordinarily be imposed unless the party obligated either acted deliberately in defiance of law or is found to be guilty of conduct contumacious or dishonest, or acted in conscious disregard of its obligation. Penalty will not be imposed merely because it is lawful to do so as held by the Hon’ble Supreme Court in Hindustan Steel Ltd. 25 STC 211.

CBDT has notified Section 206AB (TDS) & 206CCA (TCS) on 1st July 2021 for deducting a higher rate of TDS & TCS for persons not filed their Income Tax Returns for the last 2 assessment years to which the due date for filing ITR has been expired, provided that this provision will apply only when the TDS & TCS credit of that person during those assessment years are more than Rs. 50,000 each.

CBDT has bought down the conditions to last one assessment year instead of 2, i.e., TDS & TCS has to be deducted at a higher rate as specified above if a person has TDS & TCS credit of more than Rs. 50,000 and doesn’t file his ITR for the last assessment year to which the due date for filing ITR has expired. The higher rate of TDS mentioned above remains the same as before.

Labour uniform codes

As per the information gathered by me from news/media/notifications, etc on new 4 labour uniform codes- few provisions are being implemented w.e.f. 1-7-22 by Central Govt and rest shall be notified by States as per their “State – Reforms of Labour Code” and dates for implementation shall be as per their state’s gazette notification, the central rules are as under: (Attaching latest booklet on the matter)

*W.e.f 1.7.2022*

2. Basic is mandatory 50% of CTC. So pf in any case 12% on Basic that is 50% of CTC.

*Important Note:* Basic can not be less than 50% of CTC but in Minimum wages – that consists of Basic + DA as part of basic therefore for those employees who are getting minimum wages can not be further bifurcated.

The central government has notified four labour codes, namely,

1. the Code on Wages, 2019, on August 8, 2019; (amalgamated 4 laws)

2. the Industrial Relations Code, 2020, (amalgamated 3 laws)

3. the Code on Social Security, 2020, (amalgamated 9 laws) and

4. the Occupational Safety, Health and Working Conditions Code, 2020 on September 29, 2020. (amalgamated 13 laws)

The statutory minimum wage is based on the gross wage payable for a normal working week, i.e. before overtime payments.

MINIMUM WAGE COMPONENTS:

1. the basic wage agreed in your contract;

2. performance-related payments and allowances for shift work, irregular hours, etc.;

3. weekly or monthly fixed payments for the turnover you generate;

4. work-related payments by third parties, e.g. tips or payments agreed between you and your employer;

(The total of these amounts may not be lower than the minimum wage.)

Some income components are not included in the calculation of the minimum wage:

1. overtime pay;

2. leave allowance;

3. profit shares;

4. special payments, e.g. incidental payments received for reaching sales targets;

5. future payments you receive subject to certain conditions (e.g. pension and saving schemes to which the employer contributes);

6. expense allowances;

7. end-of-year allowances.

Your gross minimum wage depends on how many hours you work. If you work part time the gross minimum wage is proportionately lower.

Therefore, you are requested to be in touch with experts on the subject for implementing dates of Labour Codes state wise because our company works pan-India.

Read our other blog – Latest Taxation, GST and Other Updates

Properties sold in India by NRIs are liable for taxation and TDS is required to be deducted under the Indian income tax laws. An NRI who wants to sell a property situated in India has to pay tax on capital gains.

In this article, we will discuss the applicability of TDS on Sale of Property by NRI in India.

Your tax liability on the sale of your property in India will depend on the period of time for which you have held it. If you sell a property that you have owned for more than 2 years, then you will be liable to pay a long-term capital gains tax. In case a property is held for 2 years or fewer, the short-term capital gains tax will be applicable.

The date of the purchase of the property by the original owner will be considered for calculating capital gains on an inherited property.

TDS (Tax Deducted at Source) shall be deducted whenever any property is sold/ purchased. The buyer needs to deduct some amount (called TDS) and pay the balance to the seller.

The amount to be deducted depends on the residential status of the seller. In case the seller is a resident Indian, 1% of the sale price of the property will be deducted as TDS.

In the case of an NRI seller, the amount of TDS to be deducted will depend on the quantum of money received by the seller.

TDS rates applicable on the sale of property owned by NRIs are as under:

Surcharges and cess would also be charged on the capital gains. Here are the effective rates of TDS on the sale of property by NRI for long-term capital gains.

| Particulars | (A) Long-term capital gains tax | (B) Surcharge on LTCG tax | (C =A + B) Total tax (incl surcharge) | (D) Health & education cess | (C+D) Applicable TDS rate (incl surcharge + cess) |

|---|---|---|---|---|---|

| Sale price < Rs. 50 lakh | 20% | Nil | 20% | 4% of total tax | 20.8% |

| Sale price Rs. 50 lakh to Rs. 1 crore | 20% | 10% of LTCG tax | 22% | 4% of total tax | 22.8% |

| Above Rs. 1 crore | 20% | 15% of LTCG tax | 23% | 4% of total tax | 23.92% |

TDS on sale of property by NRI in India

The maximum surcharge rate on tax payable on dividend income and capital gain mentioned in Section 112 of the Income Tax Act has been capped at 15% as announced in Union Budget 2022.

Hence, regardless of whether the value of the property sold by an NRI is Rs. 1 crore or Rs. 5 crores, or even Rs. 10 crore–the rate of TDS will remain the same i.e. 23.92%.

In the case of short-term capital gains, surcharge and cess would be added to the applicable tax rate as per your income tax slab in the same manner as in the case of long-term capital gains.

The TDS shall be deducted when any payment is made to the NRI seller for the purchase of property, even if the advance is being paid. The TDS shall be deposited by the buyer with the Income Tax Dept.

The TDS on the purchase of property from NRI shall be deducted regardless of the transaction value of the property. Even if the price of the property is less than Rs. 50 lakh, the TDS shall be deducted.

The legal basis for VAT refunds can be found in Art. 107, s. 1, b of the Swiss VAT Act and to art. 151 to 156 of the VAT Ordinance (OTVA).

The Federal Administrative Court has just confirmed the practice of the AFC concerning the content of the certificate required for the reimbursement of Swiss VAT paid by foreign companies.

To be entitled to reimbursement, a foreign company must, among other things, prove to the Swiss tax authorities (AFC) that it has the status of the company in the country in which it is domiciled, or in which it has its headquarters or a permanent establishment (see art 151, paragraph 1, letter d, OTVA).

The certificate issued by the foreign tax authority must be valid for the reimbursement period (calendar year).

Insofar as reciprocity is granted, and the country has a VAT system (see list of these countries on the AFC website), it is essential that the certificate confirms that the applicant is registered with the register of persons liable for VAT during the period for which the VAT refund is requested, or indicates the date from which the applicant is entered in the register of persons subject to VAT.

Insofar as reciprocity is granted, and the country does not have a VAT system (see list of these countries on the AFC website), it is essential that the company certificate confirm the applicant’s status as an entrepreneur during the period for which the VAT refund is requested, or indicates the date from which the applicant has the status of the contractor.

Attention, if the above conditions are not met, the AFC will not be able to process the request, nor refund the Swiss VAT!